Equal Pay Day Underscores Just How Unequal Women’s Wages Are

April 20th, "Equal Pay Day," is the day when the average female worker’s wages will finally catch up to her male counterpart’s salary from the prior year.

“Equal pay is by no means just a woman’s issue—it’s a family issue…And in this economy, when so many folks are already working harder for less and struggling to get by, the last thing they can afford is losing part of each month’s paycheck to simple and plain discrimination.” President Barack Obama, 2009.

April 20th is “Equal Pay Day,” the day when the average female worker’s wages will finally catch up to her male counterpart’s salary from the prior year.

The fact that the wage gap declined by only 18 cents over the past three decades is, according to the National Women’s Law Center evidence of “the lack of women-friendly and family-friendly economic policies in the United States.”

According to NWLC:

On average, women who work full time make 77 cents for every dollar a male earns, and the disparity is even greater for women of color. This wage gap exists in every state and persists even after factors such as educational level and occupation are taken into account. The accumulative amount of “lost” money adds up to a substantial amount over a lifetime and leads to shortfalls in retirement benefits for many women.

In fact, according to the National Committee on Pay Equity, the gender wage gap has widened in recent years.

Liz O’Donnell of GlassHammer writes:

In 2007, women earned, on average, 78 cents for every dollar a man earned. In 2008, they earned 77 cents. That’s the same amount reported in 2005. So not only have we made no gains in closing the wage gap over the last three years, we have slid backward..since The Equal Pay Act made wage discrimination on the basis of sex illegal.

Tina Vasquez also of GlassHammer states that “in 1963 when the initial act was signed into law women were making 59 cents on the dollar compared to men. Essentially, this means that in the past 47 years we’ve only made up for 18 cents!”

So, as NWLC notes, “wage disparity is an old story—one that repeats itself year after year.”

And its easy to get complacent about this issue: After all, when you have a “day” to demarcate an important issue, it is easier to observe and then move on with business as usual. You’ve done your job; you’ve “observed” the problem and you can wake up to another day. But the wage gap is not only inequitable, it also takes a huge economic toll on the United States.

Today, women are close to outnumbering men in the workforce. “In this tough economy –where 3 out of 4 people laid off have been men—women are shouldering increased responsibility for supporting their families,” says NWLC.

Since 2008, nearly 40 percent of mothers are primary breadwinners for their families, and that percentage is growing. So the wage gap intensifies hardship for entire families—for those headed by single mothers and those relying solely on wives’ earnings while husbands search for work.

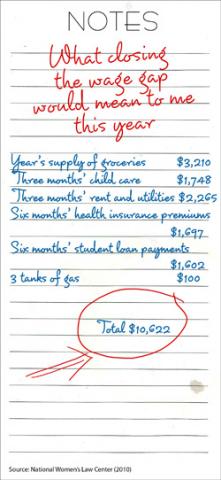

NWLC suggests looking at the issue in terms of a “shopping list” of purchases women could make using the additional $10,622 in disposable income available to them should that wage gap close.

“What could women do with this money—for themselves and their families—if they earned an equal wage?” asks NWLC. “Perhaps they’d put it toward paying for child care, or student loans, or health insurance premiums.”

The Senate is expected to vote sometime soon on the Paycheck Fairness Act, which passed in the House in 2009. This bill would strengthen workers’ ability to prove that they have been subject to sex discrimination leading to disparities in paying women and men equal pay for the same work. The Act would also offer concrete remedies in cases where violations are found. Organizations such as NWLC are working to mobilize the support necessary to get the Act passed.

“It’s time for women—who make up almost half of the workforce—to receive equal pay,” states NWLC.

I’d say it’s more than 50 years passed time.